So, you got a tax cut. Now what?

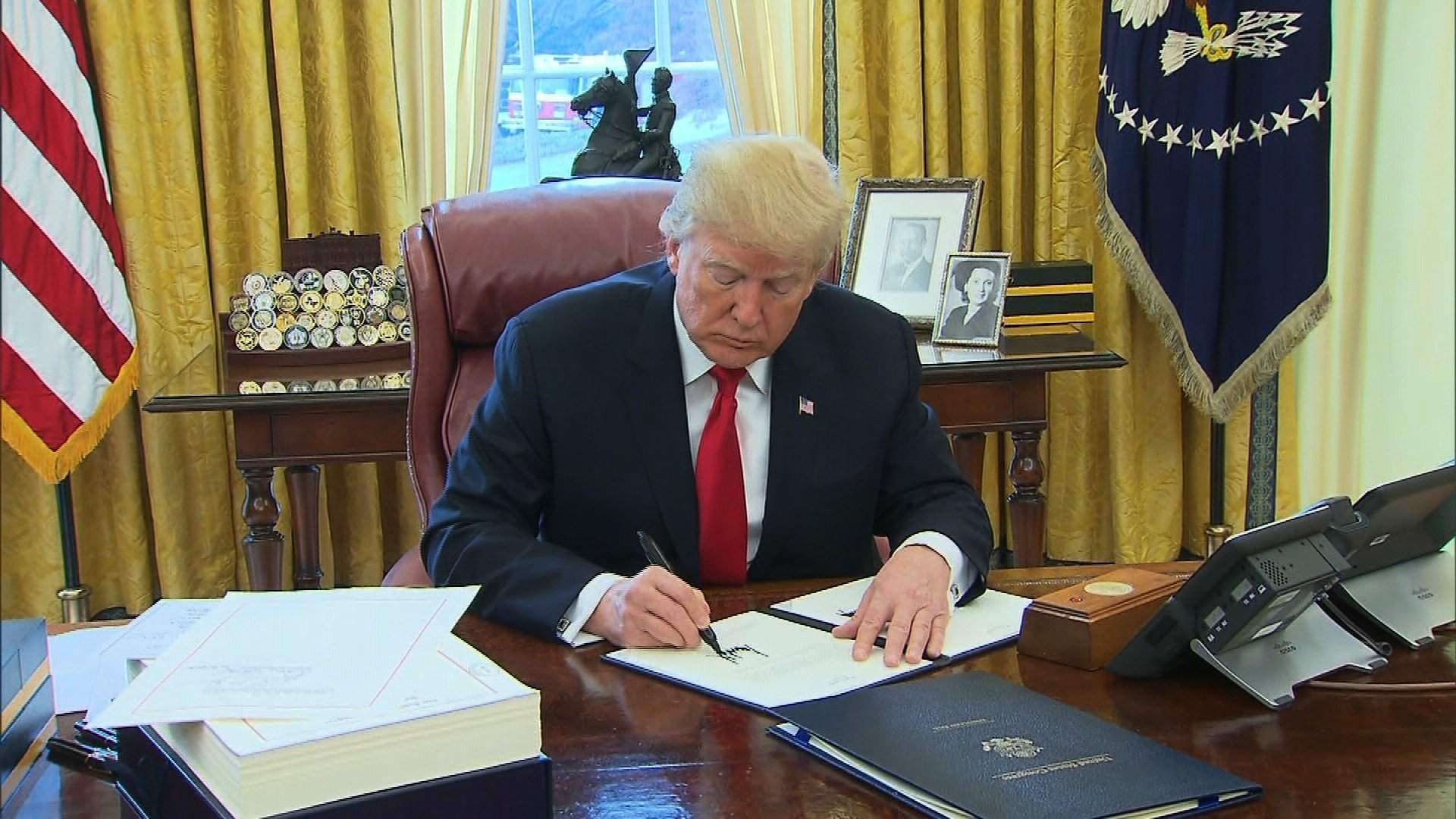

Trump signed the bill into law

The tax bill has just been signed into law, and with CNN’s tax calculator, it’s possible to find out how much you’ll save (or lose) next year because of it.

So, how are people planning to spend their windfalls, which the Joint Tax Committee says will be worth $264 billion over the next two years?

It’s an important question for the economy. Companies determine who benefits from tax cuts by whether they choose to put their extra cash into payouts to shareholders, wages and hires, or new investment. But spending by individuals accounts for more than two thirds of gross domestic product, so their decisions are arguably more important.

We know a few things from past tax cuts.

One, individuals don’t always notice the change — it’s just one of many factors that influence the amount of money in their pockets, including wages, rent, the price of gas, the cost of college. President Barack Obama passed a tax credit as part of the 2009 stimulus bill worth $400 per person, for example, but polls showed later that few people realized it.

Two, we know that people spend tax cuts differently depending on how much money they make. Economic theory generally says that lower-income people are more likely to spend any extra cash they get, while upper-income people are already spending as much as they want or need to spend, so they just sit on the money.

University of Chicago economist Owen Zidar found in a recent study that the theory holds: Places with a higher concentration of wealthy people saw less of an economic boost from tax cuts in the last 30 years than places with more poorer people.

By that logic, this tax cut isn’t structured for growth. According to the Tax Policy Center’s calculations, people in the bottom 90% of the income spectrum will see less than a 2% tax cut in 2018, while people in the top 5% see about a 4% cut.

We don’t know what’s going to happen with this tax bill. Consumer spending is already very healthy, with today’s report showing 0.4% inflation-adjusted growth in November, driven by car purchases, recreation, and utility bills.

But when we asked readers, many of them said they’ll save the extra money, or use it to pay off loans. That makes sense. Consumer debt is now at an all-time high. Delinquency rates are creeping upwards for auto loans and credit card debt, while people are behind on their student loans at almost as high a rate as ever.

If taxpayers decided to save the money, they’d be reversing a longstanding trend that only turned around for a short time after the recession, and putting themselves in a better position in case the economy stumbles.

Either way, research shows that consumers probably won’t do much until the extra money actually shows up in their paychecks. For some people, that might happen as soon as February, after the IRS issues new rules for federal withholding. Others may need to wait until next tax season to see the difference.

Here’s what people texted us in response to a question on our tax liveblog about what they’re planning to do with any savings after using our calculator to figure out what the tax bill means for their wallets.

DeAries Martin, 28, Dallas,Texas

Taxes going down in 2018 and after-tax income going up 2.7%.

‘Save for vacation’

James Deal, 52, Smithville, Texas

Taxes going down in 2018 and after-tax income going up about 3%.

‘Save it for when the, you know what, hits the fan.’

Brandon Lindahl, 27, St. Paul, Minnesota

Taxes going down in 2018 and after-tax income going up 3.1%.

‘Debt and savings.’

JL, 45, Houston, Texas

Taxes going down in 2018 and after-tax income going up 2%.

‘I don’t think it will be enough to be substantial do not planning on doing anything with it.’

Rian Whitman, 31, Ohio

Taxes going down in 2018 and after-tax income going up 1.9% .

‘Save for my daughter’s college fund’ [His daughter is 7 years old.]

Kevin, 31, Milford, Connecticut

Taxes going down in 2018 and after-tax income going up 3.2%.

‘Pay off student loan principal’ [He has about $50,000 in student loan debt]

Ann Johnson, 46, Huntsville, Alabama

Taxes going down in 2018 and after-tax income going up 3.1%.

‘Probably try to save it or add to credit card payment’

Harold Fonseca, 20, Davenport, Florida

Taxes going down in 2018 and after-tax income going up .4%

‘I’m gonna save that .4%!’

Kellie Jones, 54, Laguna Niguel, California

Taxes going up.

‘This does make me consider if I’ll be retiring in a neighbor state that has no state income tax. I highly doubt I’ll move. I love my California lifestyle.’

Steve Shell, 30, St. Louis, Missouri

Taxes going down.

‘Probably invest some in this bitcoin craze eventually but increase my savings % into my 401k.’

Jaime, 32, Brookline, Massachusetts

Taxes going down in 2018 and after-tax income going up 2.7%; about $92 a month in after-tax income.

‘Most likely pay down debt, and find a way to give a little to an organization whose funding is likely to be cut by this administration’ ‘Couldn’t even get cable for that amount’ ‘Doesn’t cover half of a doctor’s visit.’

Dannielle, 47, Champaign, Illinois

Taxes going down in 2018 and after-tax income going up 2.7%.

‘HAHAHAhAhAHAHAHAHAHAHAHAHAHA Buy a pizza?! Oh, wait, you are being serious. Since just about everything else (insurance, gas, power, cable, groceries) is going up in price. It mostly averages out to a increase of 30$ each pay cycle. Between 2 jobs I still end up owing money each tax season anyway.’

Dan Sczcepaniak, 45, Baltimore, Maryland

Taxes going down in 2018 and after-tax income going up 4.7%.

‘Pay more on bills and use some for vacation/house projects.’

Popular ahora

Welcome to Noticel

Start creating an account

Verificación de cuenta

Te enviamos un correo electrónico con un enlace para verificar tu cuenta. Si no lo ves, revisa tu carpeta de correo no deseado y confirma que tienes una cuenta vinculada a ese correo.

Forgot your password?

Enter your account email address and we'll send you a link to reset your password.

Forgot your password?

Le hemos enviado un correo electrónico a {{ email }} con un enlace para restablecer su contraseña. Si no lo ve, revise su carpeta de correo no deseado y confirme que tiene una cuenta vinculada a ese correo electrónico.

Personalize your feed

Please verify that your email address is correct. Once the change is complete, use this email to log in and manage your profile.

Choose your topics

- Sports

- Economy

- El Tiempo

- Entertainment

- More

- News

- Opinions

- Last Minute

- Life & Wellness

- Videos and Photos

Comentarios {{ comments_count }}

Añadir comentario{{ child.content }}